SOLOCAL

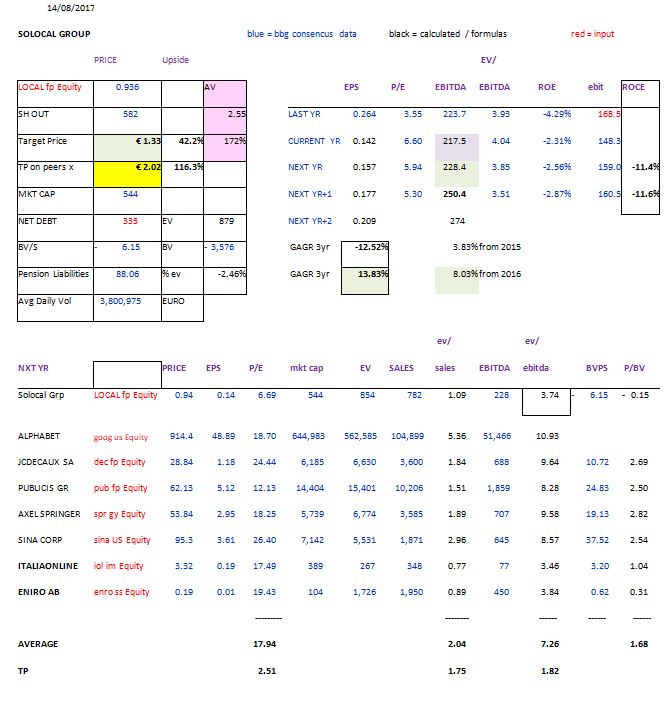

Target Price €1.33 (upside of 42%)

TP on ev/ebitda €2.03 (upside of 115%)

Solocal Group is principally engaged in local online communication. The Co provides digital content, advertising solutions, and transactional services connecting people with local businesses. Solocal also supports the online development of SME. The print business (Yellow Pages) is slowly dying (15% of revs). They also own Mappy.

The departure of Jean-Pierre Remy, the CEO for the last 8 years, and the arrival of the new CEO could prove to be beneficial and help the group make a fresh start. While a number of risks and uncertainties remain (the need to reverse the declining customers’ trend; raise audience monetisation; high competition; negative shareholders’ equity) a lot has already been done, especially on the financial structure side with 2 highly dilutive capital increases in 2014 and 2017. At the end of Q1 2017, the co had 335mn of net debt or 1.45x net debt/EBITDA which should go down to 1x by 2019.

The management has been caught by the shift to digital and the structural decline in print directories. While internet is the largest contributor, c.58% in 2012 to 80% in 2016, the company has seen its customer base eroding. That being said in the most recent quarter the company is finally seeing a stabilisation of its customer base with 477k in Q2, in line with Q1 numbers but still lower vs. last year Q2 of 501k. At the same time they have managed to increase ARPA over the recent past with a 5.74% increase in 2016 to €995. On a rolling quarterly basis, ARPA has grown 6.5% since Q4 2015 from €941 to €1002 with a peak a €1013 in Q1 2017. I believe that as soon as the company shows that they are (again) growing their customer base and ARPA the stock will witness a strong re-rating.

Solocal offers content to generate audience which over time are monetised but so far it has been rather difficult. 95% of their revenues are generated in France. 2/3 of their traffic is generated by 3rd party web-sites, with Bing contributing 25%.

The French digital addressable market is around €6.5bn of which digital marketing account for €4bn and digital advertising €2.5bn, these markets are growing at about 7/8% and 4%, respectively. Can the company grow their market share to 15% or more vs. about 12% today?

The “Conquer 2020” aims to generate sustainable high single digit internet and EBITDA growth from 2018 and onwards. FCF is expected around the €90mn/year and EBITDA margins at 28/30%. The management has guided for ARPA of €1052 in 2018 (vs. €1002 in Q2), which looks more than achievable in the current economic environment. The new CEO could also tackle the low sales/employee (€178k vs peers at >€300k) to further enhance margins.

The stock currently trades on a VERY cheap 3.85x 2018 EV/EBITDA while peers are on more than 7x. If the management (the new CEO) achieves the “Conquer 2020” goal, the stock should witness a large re-rating further enhanced by the strengthening to the balance sheet. The stock could/should DOUBLE over the next 2 years: BUY