ALTICE

Its been a wild ride but for us. The valuation was too compelling and contrary to what the mkt pushed there was no re financing due till 2022, EBITDA margins remained healthy so talk of bankruptcy was premature. However the market created a self fulfilling sell off which created an opportunity.

We step aside now without having had a major heart attack.

Closing + +45.83% ABS & 42.81% REL

ALTICE

BUY: ALTICE TO SPIN OFF US DIVISION

Tuesday• 9th January 2018 • 08:49

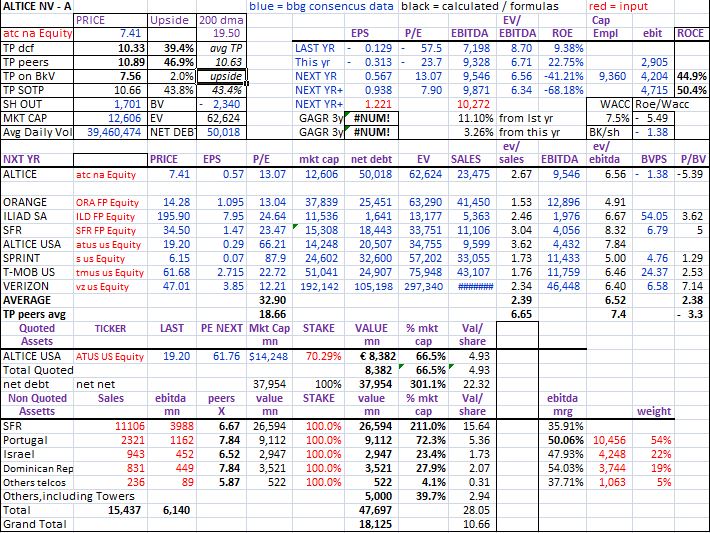

On my SOTP, Altice USA is worth €7.6/share of Altice … Net debt will mechanically go down has ATUS has close to $38bn of debt … On my SOTP, Altice is worth €17/share with SFR valued at 28bn on a EV basis … ATUS is to distribute a 1.5bn dividend prior to the spinoff … Mr Drahi will keep control of both Altice USA and Altice NV (Europe)…. BUY +27% so far

SHORT INTEREST: 20.4% of ffloat, 9 days to cover, 99m shares short: Markit, decent SI still!

ALTICE

BUY ON THE BACK OF VERY COMPELLING VALUATION, PT €10.90

Monday• 4th December 2017 • 16:10

Short to medium term BUY thesis:

*No financing worries, as they have no debt due before 2022

*EBITDA margins remain healthy with further cost cutting potential

*Management targeting 45% EBITDA margins by 2025 with Mr Drahi and Mr Goei back in charge

*My DCF valuation calls for a €10.90/share and €11.40 on a SOTP

The recent collapse in the share price has frightened investors as the volatility has increased sharply due to the equity now representing a much smaller part of the EV – This creates an opportunity for the more confident investors

Description

Altice provides end-to-end telecom services that nearly span across the globe. The company offers broadband internet services, cable TV services, mobile phone services and fixed line services and sells them in bundled packages. The company has grown quickly through a series of acquisitions which has resulted in relatively margins (and debt).

Analysis

The net debt is around €50bn. This has up until recently not been too worrisome as Altice’s margins are more than 41% which is substantially higher than for the peers (management guiding to 45% by 2025). It could however quickly become a problem if customers start to leave.

In my SOTP I have the equity value of SFR at around €10bn (€28bn on an EV basis). It was above €15bn when the minorities were bought out last August.

Management has recently stated that they will focus their attention to deleverage the balance sheet by through the potential sale of noncore assets. An example is the Dominican Republic Telco business which is valued at 3.5bn (1.8/share) as well as Towers which is also valued at 3.5bn. Altice paid 1.1bn for the Dominican telco business in 2013 which has an EBITDA of EUR 450m.

At the same time SFR’s CEO, Mr Combe, has resigned and Mr Drahi and Mr Goei (Altice USA’s CEO) are back in charge which should be a plus. Capex is due to peak this year which will further help deleveraging. Altice USA (ATUS) should progress well even if a merger with Charter is off the table following the weakness in the share price. ATUS accounts for about 58% of Altice market cap or 4.6/share.

Conclusion

BUY on the back of very compelling valuation with avg TP of 12.08 on DCF relative to the peers and a SOTP valuation at 11.6/share providing an upside potential of 43%