CLOSING AIR VS SAF

Following the FT headline yesterday : EU Competition Probe Targets Aircraft Components, Service. The spread tightened and Safran suffered.

We spoke to Safran’s IR last night for more clarification:

At this stage this is just an informal inquiry by the EU Commission. Safran is in the process of answering the questionnaire, and according to the IR “this is simply an information gathering exercises”.

There is no investigation going on at the moment. Safran will fully cooperate with EU Commission to help them understand the MRO industry (SAFRAN IR).

Our view is that currently no investigation. May well happen eventually but for now it is just a fact gathering exercise.

Safran have Q3 sales numbers on October 22. Although the stock is still priced for perfection we expect numbers to be ok as the after-market is performing well.

For these reasons we use yesterdays weakness to close the trade and take profit.

Initially we where looking for 8-10% but are happy to close for 6.78% following yesterdays FT headline.

DISLOCATION CREATED BY EUROSTOXX AND CAC RE-WEIGHT

Thursday • 24 September 2015 • 13:34

This trade is on the out performance of Safran on back of the EUROSTOXX and CAC re weight (effective close 18th Septemeber).

As Airbus and the market has sold off Safran has outperformed due to the buying pressure.

According to JPM the buying pressure was 8.83 days of volume or 958mn USD.

There are no other reasons for the out performance.

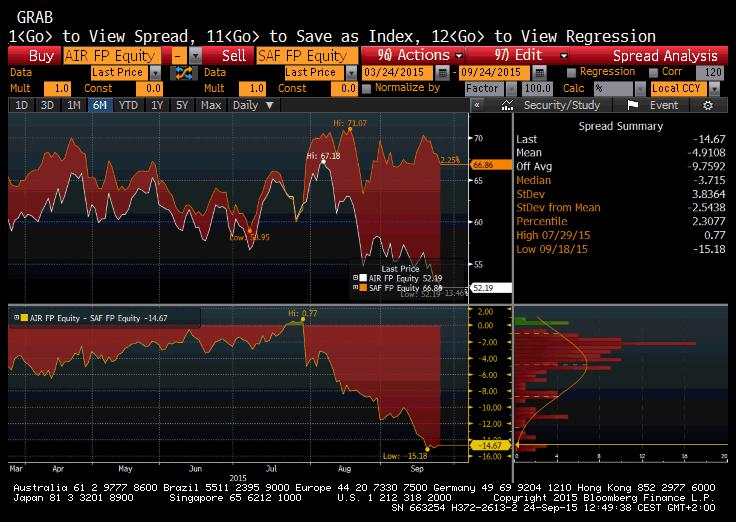

In the last 6 months they have traded within a 5% range with a standard deviation of 3.8%. Safran trading at a premium.

Currently the spread is trading at 15%.

We are looking for the spread to revert to the mean of 5% so locking in a 10% profit.