SAINT GOBAIN

Compagnie de Saint-Gobain manufactures glass products, high-performance materials, and construction materials. They produces flat glass, insulation, glass containers, high-performance ceramics, plastics, abrasives, and building materials such as gypsum, roofing, wall facings, mortars, and ductile cast iron pipe. SGO also retails building materials through Point P in France and Jewson in the UK.

While the company is benefiting from the cyclical recovery (a rising tide lift all boats), they have destroyed capital over the past 10 years as operating performance has been and remains subpar.

As per TAVIRA /AlphaValue research:

SGO’s governance (the board is mainly French!) is ineffective as exemplified by the SIKA saga and the Wendel fiasco. Saint-Gobain displays neither exceptional industrial acumen nor any financial talent (buying at the top) when it comes to enhancing value.

In 2007 there were 1,416 consolidate entities and despite a sharp improvement, in 2016 there were still 744 which in turn requires a lot of management layers (Mexican Army) making the company very inefficient.

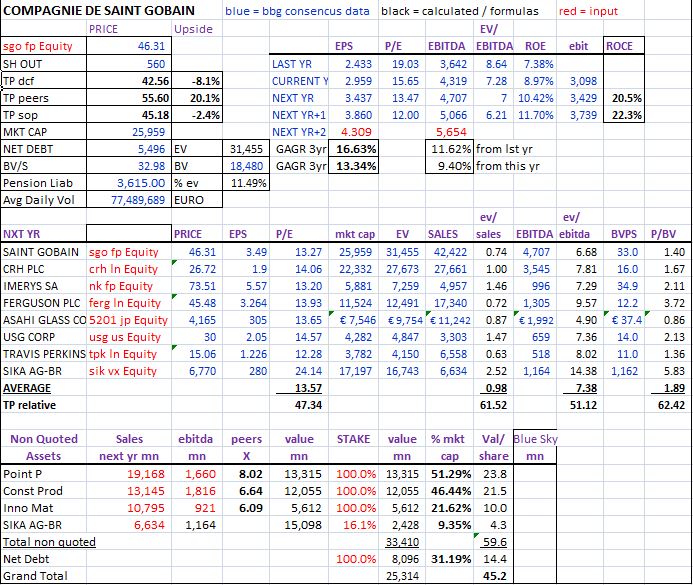

As per the below DCF and SOP the stock is overvalued. SELL