BUY TELECOM ITALIA

Cheapest Telco in Europe with largest upside with strong quarterly earnings for the past 3Q. Consensus remains well below management guidance.

Telecom Italia S.p.A., through subsidiaries, offers fixed line and mobile telephone and data transmission services.

Telecom Italia is set to dominate TV distribution in Italy with a market share similar to the 50% it enjoys in classical Fixed broadband. There is no cable operator in Italy and Italian homes are rapidly expected to end up watching TV via the telcos. By the end of 2017, >75% of the population will have access to fibre and >96% to 4G! Furthermore, the Italian group is entering the age of the ultra-fast broadband networks with a very solid domestic margin at 45+%. The co-founder of GVT, Amos Genish, is due to takeover as CEO of TI. Vivendi sold GVT to Telefonica in 2015 and clearly Bolloré thinks highly of him. Bolloré’s position as first shareholder in TI combined with Vivendi’s firepower & political influence obtained through Mediobanca should allow TI/Vivendi to be well positioned as a key player in the restructuring of Italy’s audiovisual sector as well as in content production and delivery in southern Europe.

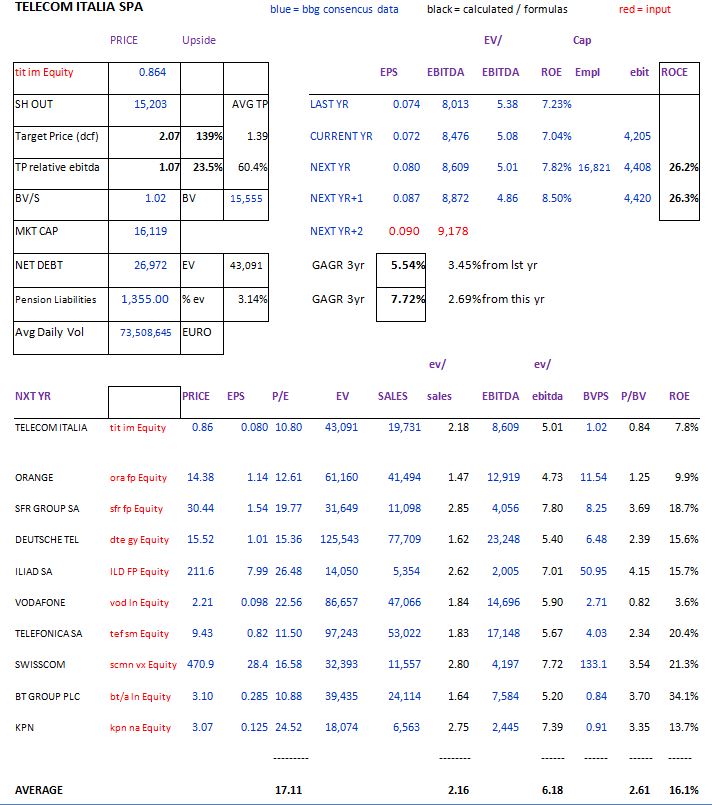

Despite the 3 year Strategic Plan, (The turnover and domestic EBITDA (the latter with a “low-single digit” YoY increase) are confirmed as increasing YoY for the entire duration of the Plan; Capex / Group turnover ratio at the end of the three-year period below 20% (25% today); Ratio of adjusted net financial debt to reported EBITDA below 2.7x in 2018 TIT) TI remains one of the cheapest telco in Europe. As evidence by the consensus estimates below mgt guidances. Current valuations (DCF and relative ebitda and BV) point to TP of €1.39. If one looks at TI long bonds (TITIM 7 ¾ 01/33 Corp) the equity should catch up. The bond has rallied +8%, over the last 2 years, outperforming the equity by 35%.

On the valuation front (see below), my DCF gives a TP of €2.07 and a relative to peers ebitda of €1.07. Co has an estimated ROE of 7.8% (2018) and a WACC of 6:45% which should warrant a premium to the current book value of 1.02. Furthermore, European macro data has been powering ahead, which should favour domestic play like TIT.

BUY TELECOM ITALIA

ANOTHER TICK IN THE BOX

Friday • 24th March 2017 • 11:38

Nothing new in the numbers but an acceleration of its broadband coverage at no extra cost is a positive vs worries about ENEL as a new entrant.

This is another tick in terms of the ‘show me’ execution that is required for the stock to re-rate.

We continue to think it is cheap, with a positive catalyst likely at Q1, and a large gap between cons and mgmt guidance that is likely to close over time.

BUY. 20% Upside.