SHIRE

Superb Drug Pipeline –Strong Acquisition Track Records – Great Value –

Management Second to None, the way Shire management team has developed the controversial drug ADHD is a testimonial their capabilities

Shire is a biotech company focusing on specialised and rare diseases across 7 therapeutic areas – haematology (20%), genetic diseases (25%), neuroscience (23%), immunology (14%), internal medicine (16%), oncology and ophthalmology.

Shire made it to the big league on the back its ADHD drug, Adderall and Adderall XR (which has been suffering generic erosion since 2012 and is now succeeded by Vyvanse) and via acquisitions where they are buying out late stage products/assets with high-risk/high-reward profiles. SHP’s latest potential blockbuster is a dry-eyes treatment, Lifitegrast with potential peak sales of $1.5bn. Shire has an impressive drug pipeline among which SHP607 (a protein-replacement therapy for premature retinopathy; in phase III with a fast-track designation from

the FDA), SHP621 (a breakthrough therapy designated candidate for eosinophilic esophagitis, and SHP643 (HAE, peak sales expected at $2bn by management).

Shire’s is focusing on the rare diseases space with a 13% share of a $60bn market. This space benefits from a favourable operating environment (7 years from approval irrespective of the research time), reduced R&D (tax credits, grants and waivers), premium pricing and higher margins, etc. As well as expected growth of more than 7.5% CAGR over the next 5 years. Shire is market leader (36%) in haematology (10bn market) and in immunology (20%). They are also a leader in Hereditary Angioedema (HAE) market with Cinryze (long-term prophylaxis) and Firazyr (acute setting), with combined sales of $1.3bn in 2016.

In the past, the small patient population was a big deterrent for the Big Pharma and other players to invest, in addition to complex manufacturing process which resulted in limited competition. It is slowly changing because of the premium pricing.

Roche’s Emicizumab (approval in 2018) could take market share in the haematology, which is one of the reason of the very attractive relative valuation of Shire.

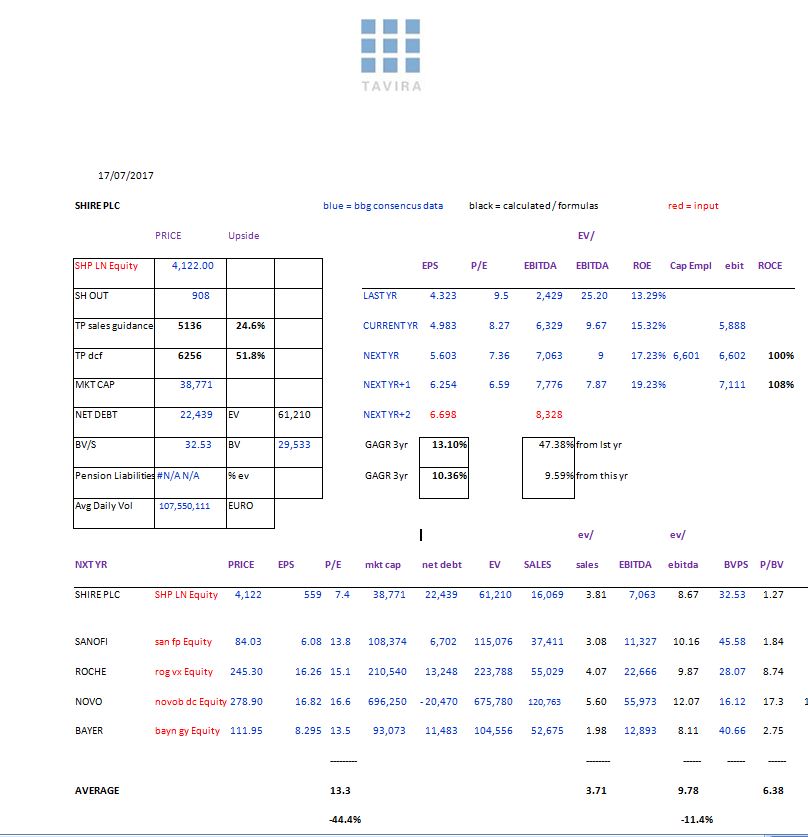

Hugely undervalued with a 50% upside

Despite its strong fundamentals, Shire is trading at a significant 2018 P/E (8x) and EV/EBITDA (8.8x) discount of 44% and 11%, respectively as well as its five-year historical P/E average of 14x. The Baxalta acquisition is the main reasons as the business has lower margins than historical Shire margins. Looking forward, Shire should get approvals on “several” drugs during the summer: today’s valuation is assuming the worse case scenario while the company offers above average growth (9.5%, 3year CAGR on consensus ebitda)

The weakness of the shareprice following Zydus Cadila (an indian generics company) approval of their generic form of Lialda is a good BUYING opportunity. Consensus was expecting the generic to come next year, hence no big change in the fundamentals. STRONG BUY