RESEARCH REVIEW for 1H 2017

Following a 7 year sabbatical, I am again trying to find and recommend great value in the European markets.

As in the past, I am researching companies trading at a substantial discount to peers on SOP/NAV, relative valuation and DCF with a catalyst to realize value.

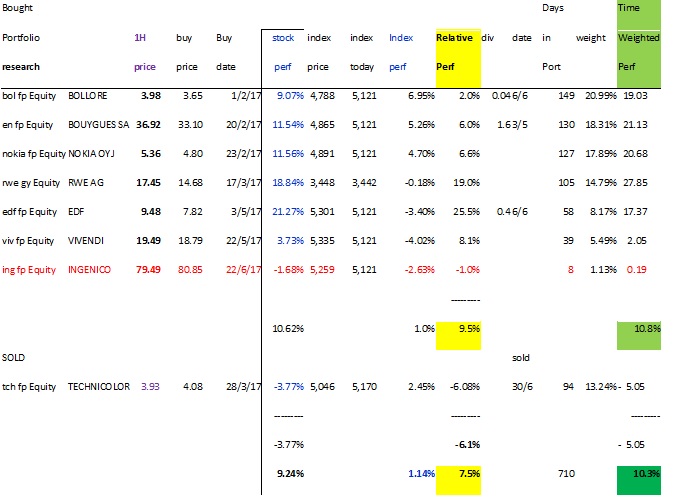

I have written on 8 companies (7 buys and 1 sell) over the past 6 month with an overall return of 9.24% (11.2% on time weighted basis) or a 7.5% relative outperformance vs. the indices.

The election of Donald Trump exacerbated fears of the spread of populism but since his election every populist candidate has lost or receded. Macron’s popular and legislative victory in France was an important victory for globalisation. These results have reduced uncertainties in the markets allowing for a strong performance. European PMI continue to rise strongly, pointing to further stock market outperformance in the 2H, which in turn point to strong economic growth. Last but not least, European GDP is finally outperforming the US. It doesn’t look like this market is ready to correct yet.

Published research (one can access each reports on: http://monacoalpha.com/the-french-specialist/ )

• BOLLORE (€3.98): BUY on 1/2/17, up 9.07% and 2.0% relative. Current TP €5.78

Superb track record with a 12% CAGR over the past 20 years. A play on global recovery (50% of Ebitda in Africa), media and telco (Vivendi).

• BOUYGUES (€36.92): BUY on 20/2/17, up 11.54% and 6.0% relative. Current TP €47.4

It is a play on the recovering construction and media (TF1) businesses and the likely consolidation of the telecom sector where Bouygues Telecom will be the centre piece.

• NOKIA (€5.36): BUY on 23/2/17, up 11.56% and 6.6% relative. Current TP €7.06

Earnings were boosted by the patent settlement with Apple and is getting further help from the synergies from the Alcatel merger and the forthcoming 5G.

• RWE (€17.45): BUY on 17/3/17, up 18.84% and 19.0% relative. Current TP €27.98

Innogy stake is worth €24/share of RWE and the trading assets €9/share. Stock remains a strong buy as the rumoured merger of Innogy with ENGIE would unlock value.

• TECHNICOLOR (€3.926): BUY on 28/3/17, down 3.77% and -6.08% relative.

SOLD on 6/30 following the second profit warning. Results are due on July 27th and depending on the management guidance we will re-asses our view. Co. has no pricing power, but on break up the stock is worth north of €7/share –just need a catalyst to realize the value.

• EDF (€9.48): BUY on 3/5/17, up 21.27% and 25.5% relative. Current TP €15.46

Company should benefit handsomely from the Macron Presidency as he implements a carbon tax floor price of up to €140/ton by 2030 vs a market price of around €5/ton. With a floor price at €35/ton, EDF is FCF positive. The President could also push for ARENH and/or a retail price increase. France has one of the lowest retail price in EU.

• VIVENDI (€19.49): BUY on 22/5/17, up 3.73% and 8.1% relative. Current TP €26.77

One is getting a free option on Canal+ (valued at €3.4/6.3 per share of Vivendi) and the quoted assets (€5.6) if one assumes that UMG is worth the current market cap if streaming penetration reaches 15% in 5 years.

• INGENICO (€79.49): SELL on 22/6/17, up 1.68% and -1% relative. Current TP €70.0

Despite negative news flow, consensus earnings hasn’t moved much since last February profits warning. Mgt guidance of 7% sales growth and Ebitda expanding by 20bps are at risk of disappointing again. Co has been suffering

I have been working on:

• Saint Gobain: looks fully valued but the cyclical recovery will lift all boat

• Solocal: CEO that oversaw the collapse of the company, resigned in May: stock is dirt cheap, waiting for the new appointment and how he/she will stop the decline.

• TechnipFMC: while recovery is 12 months away, valuation is the cheapest since 2008. The recent merger should bring some decent synergies as they now integrated. Just need a catalyst to crystallize the value.

• Tullow Oil: leverage play on oil price. Co. is 50% hedged at 60$ this year and 25% at 50$ next year. They need a boe at 50$ to be FCF positive and the current weakness is due to more supply (shale) rather than less demand.

• Shire: one of the cheapest pharma stock. Several catalysts are coming during the summer with the approval of several drugs. On my model the stock is worth 5965p.