UPDATE: SCHNEIDER ELECTRIC

Pushing all the right buttons…

Results released by company are all supportive to our buy stance

The company expressed optimism from the previous year with signs of improving demand in China & US helping to boost margins

They also expect a full pay for Invensys out of 2014 cashflow & mentioned the possibility of buyback in future

Improving Europe will also be an ongoing catalyst for the stock through 2014

Stay long

Monday • 20 January 2014 • 8:35

JPMorgan reinstate coverage on Schneider Electric Overweight with focus on execution and FCF yield to drive outperformance. They say:

“We resume coverage of Schneider with an OW rating and a Dec 2014 price target of €69, following a period where under applicable rules and JPM policy we have been unable to publish a rating. A focus on execution over M&A should reduce market fears, allowing a ~20% discount on P/E and FCF to peers to narrow (but not close) while top line growth should be ahead of European Electrical peers. Invensys, in a best case, covers cost of capital by 2016E; strategically sound but likely to create limited value in the medium term. We would use potential pullbacks after most recent outperformance to add to positions as we would want to own Schneider on a 12 months view”.

Wednesday • 15 January 2014 • 11:51

The deal with ISYS ends tonight, and the market is generally rewarding acquirors – as seen in MCK (down post CLS1 break) and AMEC (up post the preconditional bid for FWLT).

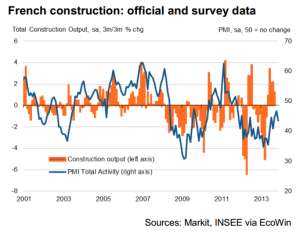

Recent headlines such as “Sick Man Of Europe” is misleading in terms of construction. See chart below. Shows construction PMI bottoming after q1 2013 and since then is on an upward trajectory..Close to breaking above 50 again.

SU actually only derives 29% of its revenue from Western Europe anyway, and this deal also diversifies SU’s exposure geographically even more.

French manufacturing figures a lot better than expected in Nov +1.3% MoM and 1.6% YoY – highest since Nov 2011.

Hollande streamlining construction approval process from 8 months to 5 mths.

The ISYS/SU spread has been very tight all along, with decent SU volumes, indicating that the stock has been pressured as people have set up the spread, particularly in the back end (recently).

SU has underperformed the CAC by 1% since the deal was announced; underperformed the CAC industrials index by almost 8% over the same time period; underperformed SGO FP by 11% since deal announcement.

Time to BUY.