Update BUY Ferro-Alloy / Vanadium, 38% ABS – Completion of Initial Investment another tick in the box

*Davis now officially taken over as chairman, this triggers the completion of the initial USD 1.6m investment which brings the total up to USD 3.1m

*New CEO has in the past spearheaded the growth of Xstrata to be the largest producer of ferrochrome and a leading vanadium producer

*Davis again highlights the need of Vanadium for the world’s decarbonisation plan and therefore something asset investors should look at more closely

*Says Balausa Project can match the significantly growing demand for vanadium as its use in high grade steel and flow batteries expands – Davis says he is convinced it will become the leading vanadium asset in the world

*As a reminder the Balausa feasibility study which has been pushed out to H1 2022 is key in the development of the company and this initial investment will now expand the scope and upgrade the quality of this ongoing study. A Phase 2 expansion to four-million tonnes a year of ore and to investigate the value of byproducts.

*We have in the past highlighted Davis is set to invest another USD 7m after consent from the Kazakhastan government which was expected by end of H1 – with Davis’s background in the field we expect this to go smoothly – after this Davis has the right to invest a further $10m @ 25p & $20m @ 78p

*Ferro-Alloy current market cap is GBP 127m

*Our medium term price target for FAR LN is at GBP 1 leaving a >300% upside.

*Blue Sky on unlock of phase 1 deposit on the estimated $2bn NPV is GBP 4, 1500% upside.

Ferro-Alloy – Update – Reiterate BUY +30% ABS, +28% REL

Wednesday • 31 March 2021 • 14:47

Medium term upside 300%, Blue Sky 1,500%

The company has just released a new corporate presentation where they highlight Vanadium as a green metal and its new cornerstone investor, the founder of Xstrata

90% of the consumed vanadium goes to the global steel industry but the company highlights in the presentation the entirely new major market for vanadium within the battery industry where they see it as standing to be the 5th most impacted of all minerals by clean energy transition

The Balasausquandiq project will be 3x the size of their existing operations with an NPV of USD 2bn which gives them the potential to be the world’s largest producer – the economimcs of scale also mean that FAR is destined to become the world’s lowest cost and most profitable vanadium producer – they estimate an IRR of the project at 89%

Davis is set to invest another USD 7m after consent from the Kazakhastan government which is expected within 3 months – with Davis’s background in the field we expect this to go smoothly – after this Davis has the right to invest a further $10m @ 25p & $20m @ 78p

The company has signed a Investment Incentive Agreement signed with the Government and pays 0% in tax until 2026

With the high profile names including Davis, Traher – the former CEO of Anglo American – and a former director of Highvel Steel and Vanadium now involved in the stock we see the company now becoming a potential growth play in the renewable field

Full corporate presentation http://www.ferro-alloy.com/en/investors/presentations-other/Investor%20Presentation%20Q1%2028%20March%202021%20FINAL.pdf

Vanadium: Heard of it? The next commodity Bull

Thursday • 25 March 2021 • 12:02

Buy Vanadium stocks on the strong fundamental outlook and a call option on renewable energy storage / ESG potential.

Summary

Vanadium is a metal few know about and less know about its potential, or even just its primary use of making steel stronger while reducing weight. This key trend of lighter and stronger is likely to only accelerate.

Traditional uses (Including EV)

The traditional uses for Vanadium are comprehensive.

They include: High strength steel structures, rebar for construction, infrastructure, automotive parts, aerospace, pipelines, power lines/pylons, Oil refineries, chemical plants, offshore platforms, railways, cargo containers, ships and construction equipment.

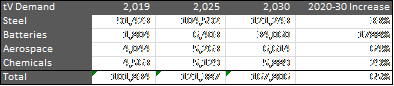

The outlook for Vanadium based on its traditional uses is very positive and we see a few trends that are set to accelerate this demand:

- Firstly, the demand for lightweight steels from Aerospace and automotive industry where Vanadium is used increasingly to reduce weight and increase strength. This is especially important for EVs where the investment community is expecting very large growth in the coming years.

- Secondly, China is increasing the Vanadium content of rebar for building and construction for environmental and safety reasons. Less than 0.1 percent of Vanadium is needed to double the strength of steel.

- Thirdly is the Vanadium Redox Flow Battery which we will look at it more detail below.

The Vanadium Redox Flow Battery – The upside call

The current issue with renewable energy is how to store electricity/energy so renewable sources can produce constant electricity for the grid. This is where the technology called the Vanadium Redox Flow battery comes in which we see an upside call option on the broader theme of renewable energy storage.

The Vanadium Redox Flow batteries are a solution for storing energy from wind and solar farms. Vanadium batteries last longer and are more efficient than lithium batteries for grid storage. For that reason, they are better suited for storing energy from solar and wind farms.

What is particularly exciting is that the potential for the redox flow battery technology has not been priced into the market for Vanadium. This could potentially give huge asymmetry should the redox flow battery gain widespread popularity, which we believe it will.

For a comprehensive summary of Vanadium Redox Flow batteries please visit the Visual Capitalist website https://www.visualcapitalist.com/vanadium-energy-storage-metal/

Vanadium in Bear Market:

So that’s the current and future uses of Vanadium dealt with. Added to this, Vanadium has been in a bear market. The Vanadium market is in a deficit but we don’t think the market is reflecting this.

Vanadium producers have announced that additional production volume is coming online, but increases in production are not matching anticipated demand for Vanadium products going forward. We like a supply demand imbalance.

HOW TO INVEST:

Ferro-Alloy Resources is our preferred name in the sector. Ferro Alloy Resources (“FAR”) is an emerging Vanadium producer based in Kazakhstan, with a listing on the LSE and a current market cap of approx. GBP 100M.

Last year’s Ferro-Alloys Vanadium output was 237.3 metric tons. In 2021 they expect to achieve significantly higher production, assisted by a connection to the high-voltage power-line, which is scheduled for completion in May.

The real reason to own FAR is the Balasausquandiq Vanadium deposit which it plans to develop into the world’s largest and lowest cost Vanadium pentoxide (V2O5) producer. The project is unique for 2 reasons – the size of the deposit and the unique nature of the geology which will make it the largest and cheapest Vanadium producer globally.

The upfront capital costs of the project are also exceptionally low which makes the project feasible in today’s price environment when many other projects are not. Phase 1 of the project will require capital costs of $100m and unlock the estimated $2bn NPV.

Invest alongside Xstrata Founder

The future potential of FAR was highlighted a couple of weeks ago when major news came out that Mick Davis, founder and CEO of Xstrata had subscribed for a 21% stake as part of a capital increase at 9p. He will take on the role as new Chairman for the company. Davis is one of the most widely recognized names within the mining industry and also considered to have brought BHP to London.

Davis said recently that the Glencore merger was his career low “The lowest point, without a doubt, was the ultimate merger or takeover by Glencore of Xstrata. Everything that I built up was essentially snatched away and that was a tough thing to actually deal with,”

Last year Davis also commented about the importance of ESG as a key metric for mining investments. This leads us to believe that Davis will devote a lot of time into this project as he is known as a hardworking and passionate character and is likely to be able to take the Vanadium Redox Flow Battery to the next level.

To put things into perspective Davis has, along with a limited amount of co-investors through his newly created battery commodity/resource-focused investment company taken a 21% stake in FAR for USD 12.6m while Davis’s net worth alone is estimated at > USD 100m.

For Davis to get involved in such a small company he must see the very large upside potential. Post Davis’s investment in FAR the stock popped from 10p all the way to 40p.

One of the company’s main issues has been securing funding to develop the Balasausquandiq Vanadium deposit. With Davis on board we see that funding an imminent.

Placing Creates a Great Opportunity

On Tuesday the CEO of FAR placed 13.3m shares to fund his divorce settlement – this brought his holding down to 14.5%. The COO also sold some share as part of the placing bringing his holding down to 20%. The two signed a 180 day lock up along with a 12 month lock up which will come into force when the Davis investments completes.

The sell-off caused by the recent placing has created an opportunity for investors to get involved in the company at a great price.

Our medium term price target for FAR LN is at GBP 1 leaving a >300% upside.

Blue Sky on unlock of phase 1 deposit on the estimated $2bn NPV is GBP 4, 1500% upside.

BUY FAR LN the next commodity BULL