GEMALTO

The board of Gemalto has noted announcement yesterday evening of unsolicited and conditional proposal by Atos to make a cash offer for all issued and outstanding shares of the company at offer price of EUR 46/sh (cum dividend in cash), company says in a statement on Tuesday.

On Nov. 28, Atos submitted proposal, valid until Dec. 15, 2017 to board of company

“The company subsequently informed Atos that it would carefully review the proposal and respond to it before such date”

Gemalto board will continue process of reviewing and considering proposal together with its financial and legal advisors in “accordance with its fiduciary duties to determine the best course of action in the interest of the company, its business, employees, shareholders and other stakeholders”

GEMALTO SHORT INTEREST 5% of ffloat, 2 days to cover, 4.3m shares: Markit

We are booking profits this morning.

Closing for +40.30%

GEMALTO

BUY WITH A 55% UPSIDE POTENTIAL

Friday • 24th November 2017 • 09:35

BUY thesis:

*The Company finally reported inline Q3 results following 4 profits warning and confirmed guidance.

*The current valuation is pricing in further disappointing results.

*If Q3 is the turning point the stock offers huge potential upside relative to the peers

*Even if Management credibility is low, the risk/reward is compelling.

Description:

Gemalto N.V. designs and manufactures security software for e-identity documents, chip payment cards, network authentication devices, and wireless modules. The Company also provides and operates systems to manage confidential data and secure transactions. Gemalto serves the telecommunications, financial services, e-government, and information technology security markets.

Analysis:

Guidance is confirmed but management credibility is low. There is continued risk on the SIM and EMV businesses which could continue to decline in Q4 and potentially in Q1. The company witnessed a 15%+ decline in the first 9 month. FX could cut as much as 3% of the sales but volume growth should more than offset it. On the bright side, the Data Protection business is performing well. The icing on cake would be positive signals for the SIM and EMV businesses. Management is putting in place a €50mn cost saving plan which should help them beat current consensus Operating Profits estimates of €338mn in 2018 vs €387mn in 2016 and €213mn in 2017.

Conclusion:

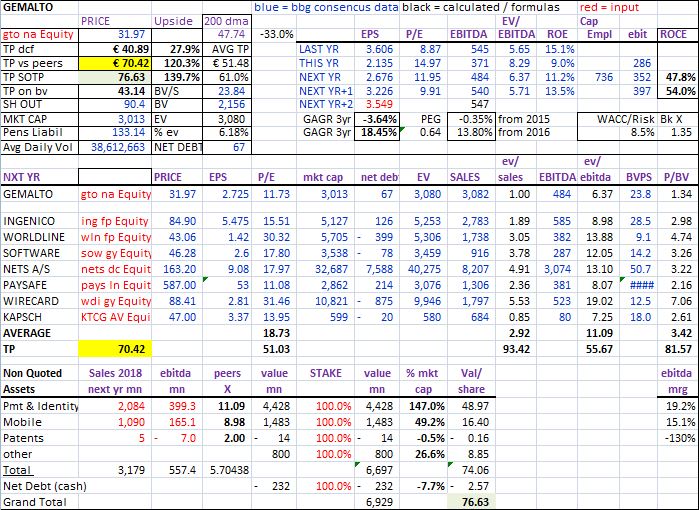

One should not wait for the proof of the recovery as the valuation warrants the initiation of a position and in the mid- to long-term Gemalto should continue to see mid-single digit revenue growth on the back of new usage of digital security solutions for IoT, automotive and others. This in turn should help margins toward the historical high-end or 16/17%. BUY with a 55% upside potential based on my DCF, relative to peers valuation and SOTP.