CLOSING BUY FTSE100 & FTSE250 +6.69% & +8.6% ABS: No Alpha generation here. Move along.

We bought due to the big valuation gap vs US and rest of Europe.

We believed upcoming catalysts such as early UK reopening,the cyclical nature of the indices, Oil moving higher and mean reversion would reduce the disparity.

Hasn’t played out at all and the trade is very boring and generating no alpha.

Booking a small profit and moving on.

BUY FTSE100 & FTSE250 – Door is still open for profit, +20% upside

Wednesday • 10 February 2021 • 14:16

*UK assets missed the rally out on the rally which has now created an opportunity

*Oil strength continues with WTI approaching USD 60

*We also feel confident about the UK GDP growth, both based on the latest job report but also on future growth as the Covid situation improves

*GBP has been very strong since the lows in March, cable gone from 1.15 in March to 1.37 GBP/USD today

*Vaccine roll-out going very well with over 18% vaccinated with only Israel ahead

*In addition Covid cases fell from 61k in the beginning of January to 21.9k by the end of the month – this is most likely more due to a herd immunity effect rather than the vaccine

*The Times has reported that Boris’s roadmap out of lockdown is expected in the week of the 22 February where we expect the measures to ease as both the immunity and vaccine efforts should be reflected

*As we are looking for UK exposure within miners and oil as a cyclicals/value trade but also expect domestically exposed sectors such as housebuilders, industrials and retailers to benefit from the early reopening – we are therefore looking at both the FTSE100 and 250

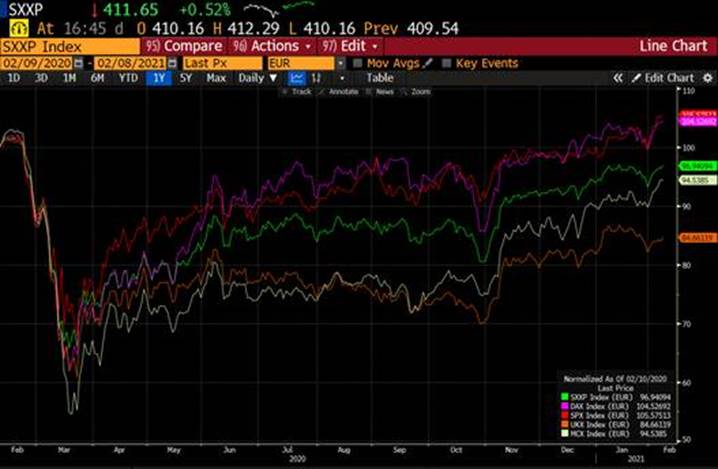

*Looking at the chart below we see that the Dax has outperformed the FTSE100 by 20% while the SXXP has outperformed by almost 15% while the FTSE250 in more inline – in EUR terms

*Liberum points out that UK equities trade at the largest discount to the U.S. market in 30 years