BOUYGUES: FULL-YEAR 2016 RESULTS

Strong commercial momentum in the construction businesses and at Bouygues Telecom.

Significant increase in the group’s current operating margin (+0.6 points).

Net debt of €1.9 billion, down €695 million year-on-year.

Continued improvement in the group’s profitability in 2017.

STRONG SET OF NUMBERS FOR US. CONSTRUCTION AND TELCO REALLY FIRING AND NET DEBT MUCH LOWER THAN EXPECTATIONS AND WILL BE TAKEN WELL. THIS IS BEFORE THE TELCO CONSOLIDATION HAPPENS IN FRANCE THIS YEAR WHERE WE SEE MID POINT SYNERGIES OF 13.5BN EUROS.

FROM OUR CALCULATIONS THE NET DEBT REDUCTION IS WORTH 2 EUR A SHARE.

We see minimum 20-30% upside in the next 6 months and a blue sky of 70% upside.

LONG BOUYGUES

GrEAT VALUE WITH CATALYSTS

Monday • 20 February 2017 • 17:49

Bouygues is a diversified industrial group with five main businesses: (1) Construction (building, civil works, energy and services); (2) Property; (3) Roads, through road builder Colas (quoted); (4) Telecoms; and (5) Media, through TF1 (quoted).

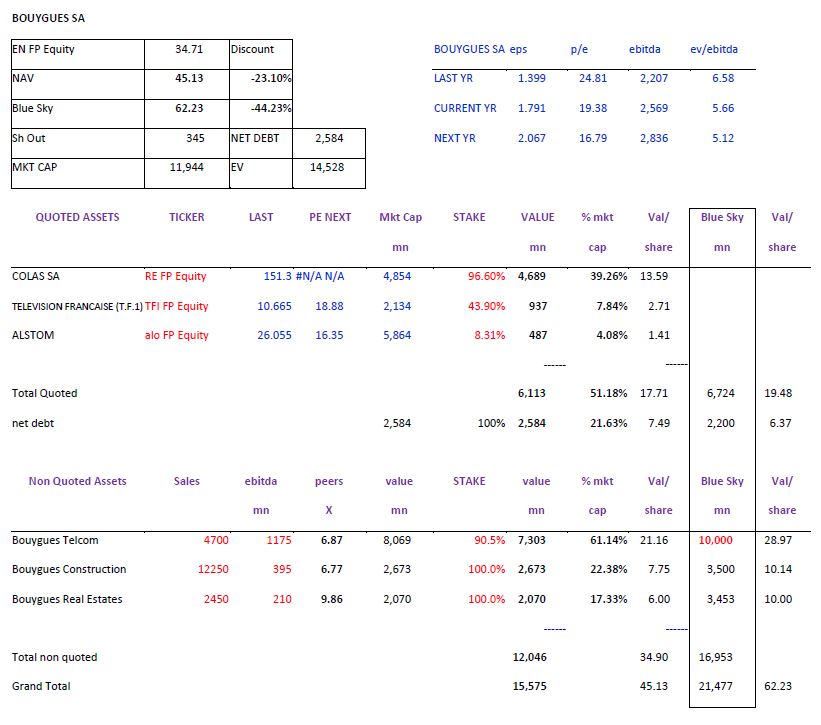

Current valuation (€34.7/share) doesn’t factor in the likely sale of B-Tel to Orange and/or SFR and the positive trend in the constructions activities. My SOP stand at €45/share with a Blue Sky valorisation at €62/share!

While the company has argued that the market does not need to consolidation from 4 to 3 players, it has also said that it would entertain a deal though which it would (1) remain in the telco market in order to benefit from data usage growth and benefit from the synergies and 2) where a deal would present low execution risk.

Over the past 3 years in the French Telecom sector, every possible merger scenarios have been considered: Illiad was rumoured to have offered €5bn in june 2014 (Les Echos), Orange pitched in May 2014 at €8bn (Les Echos), Numericable-SFR in February 2015 at €8bn (JDD), Numericable-SFR in June 2015 at €10bn (the company) and Orange in December 2015 at €10bn (Bloomberg/JDD).

The deal to sell B-Tel to Orange, however, never went through as the socialist government feared Bouygues would have too much influence on Orange. But with the upcoming French presidential elections on May 6, 2017 new opportunities may be on the horizon: both Fillon or Macron would be willing to sell down the state’s stake in Orange and therefore might even be a trigger for a deal.

Ultimately, Mr. Bouygues is likely to finalise his succession in 2017 and who wouldn’t want to do it with a big value enhancing deal? His mandate ends in April 2018. A merger between Orange/SFR/Iliad and B-Tel would allow synergies (for the industry) estimated at between €8 and €19bn vs. current combined ebitda of around €19bn. Whichever deals goes through, i.e., how they will break up B-Telcom, the combined entities could pay for the deal within a year as synergies would amount a mid-point of €13.5bn. One can assume that Mr. Bouygues will get at least 10bn for B-Telcom or €29/share. Share prices of all the French telcos players should go up sharply on any announced deal.

Construction business is picking up, as evidenced by Vinci’s recent half-yearly report, and road construction (Colas) has likely troughed last August (market up 15% in August). In public work area, the company has stated that they are seeing good momentum in Ile de France but outside that area, activities remain sluggish. The news flow in the French construction industry is improving which should boost margins and profits. At the nine month results the company reported strong order intake (+12%) and order book (1%). One of the better way to value the construction business is the cash level on the balance sheet, i.e., €3.5bn or €10/share.

Bouygues Immobilier develops residential, office and retail projects in France, Belgium, Poland and Morocco with a wide and diversified range of residential products and services. They have a genuine expertise in sustainable development. They generate operating profits of around €150mn a year or 6% of sales. Last Novembre, the company reported continued growth in residential property reservation (+23%).

Using the quoted assets at market prices (€17/share) and the rumoured price for B-Tel, the cash at B-Construction and peers valuation for B-Immobilier results in a, TARGET price of €55/share (see enclosed spreadsheet). Since the company will be more focused and will benefit from increased synergies the discount shouldn’t be too high.