NORSK HYDRO

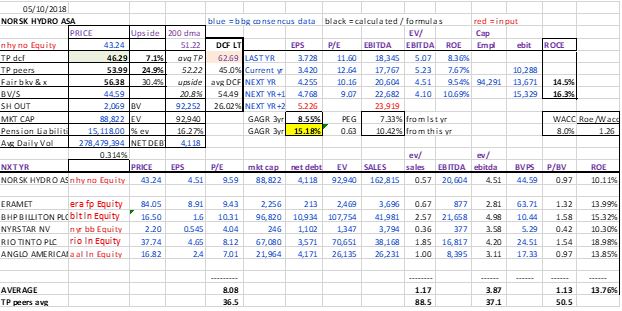

Current Price NOK43

Target Price NOK56

Upside: +30%

*The closing down of Alunorte is most likely the starting point of real negotiations (as SBM did for their settlement with the Brazilian authority)

*Norsk Hydro’s balance sheet is strong with a net debt/equity ratio of less than 0.2x and a strong FCF generation “The closing of Alunorte highlights the need for a permanent settlement as Hydro has not been allowed to install new press filters to keep the deposit area open nor been allowed to use the newly developed bauxite residue deposit area

*Short-term the company could be faced with large losses if they don’t find a settlement: In early September the company had a Term of Adjusted Conduct (TAC) that was positive where the company was going addresses additional efforts and investments related to the social development of communities in Barcarena

*The stock offers an average 28% upside to nok55/share based on DCF, peers and book value

*Short interest in the stock is around 16m shares or 1.25% of the free float (likely due to no borrow)

*The stock is down more than -30% since the beginning of the year while the Basic resources sector is flat

Analysis

*As soon as NHY settle with the Brazilian authority, the stock should trade toward its fundamental value of 55/share.

*In our view the Alunorte shut-down is an attempt by the company to force Para state to move more quickly in resolving the original issue surrounding the plant (the aluminium price hasn’t move much since the announced shutdown, ie, traders are betting that the issue will be resolved). Management has a few weeks to resolve the issue before having a shutdown for 2-3 month

Conclusion

*Based on consensus estimates the expected CAGR over the next 3 years is 14% while the stock trades on only 9.5x p/e on 2018 estimates or a PEG of only 0.68x. Over the medium term the stock could easily move up 50%.

STRONG Trading BUY