CASINO

On September 3rd we published a Trading Buy note on Casino. Taking our profits following a 40%+ jumped in the share price. On a DCF, the stock doesn’t offer anymore upside. Mr. Naouri, by getting a new 500mn credit line, has stopped the hemorrhage short term … Financing remains a problem for next year. Assets sales, especially in Latin America, might not come at the right price = take your profits

CASINO

A BUY – STOCK HAS 40% UPSIDE, ASSET SALES WILL STRENGTHEN THE BALANCE SHEET

Tuesday • 4th September 2018 • 12:15

Short to medium term BUY thesis:

*Muddy Water tweet on Friday August 31st, 2018 was irrelevant to the group and its shareholders

*Since the beginning of 2018 Casino has had strong revenue growth as the company invests in its own delivery capabilities, the relaunch of Geant Casino and Leaderprice and the continued strength of Monoprix which allowed the company to reiterate its guidance

*Short term Casino has the cash and the credit line to refinance the debt due

*The company is currently taking advantage of favourable market conditions and buy back bonds and shares

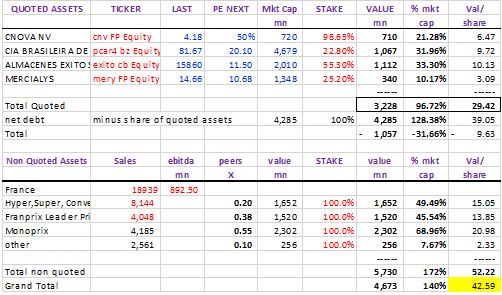

*Casino balance sheet is reasonable: The June announcement of €1.5bn of assets disposal over 2018/19 and net debt of less than 1bn will put the balance sheet back on a strong footing

*The balance sheet problems are at the parent company level, Rallye, which forces Casino (Naouri) to sell assets faster than expected as well as pay a semi-annual dividend to help Rallye service its debt

*With Naouri at the helm of both companies we expect the banks to show a lot of good will as he is very well connected – he is a graduate of ENA and was part of the Inspection Générale des finances, the auditing and supervisory body of the French Administration

*Short interest in the stock is at more than 15% and the stock is down more than 45% since the beginning of the year

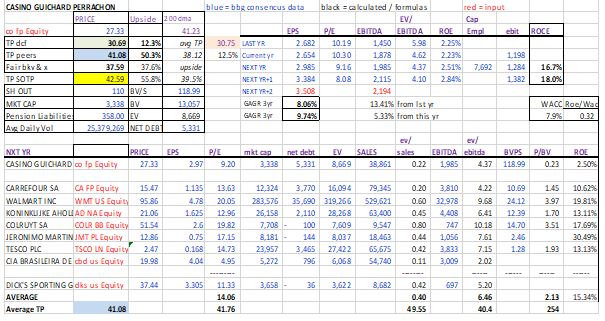

*The stock offers a 40% upside – The share are trading on a relatively low p/e of 9.2x 2018 vs peers at 15x. – an average of our DCF, peers and SOTP comes out at EUR 38 / share

Conclusion

Naouri’s leadership and achievement as CEO of Casino, Rallye and Financière Euris has shown that he has what is required to deliver on his asset sale plan and give Casino a strong foothold

We believe Casino has levers to help its deleveraging process in addition to the SOTP angle which gives substantial room for error and management needs to convince the market that:

1) It can effectively deleverage the holding company

2) Simplify the Latam structure

3) Create a clear picture of how they account for non-consolidated franchises – as shown in the slide in the note

STRONG Trading BUY