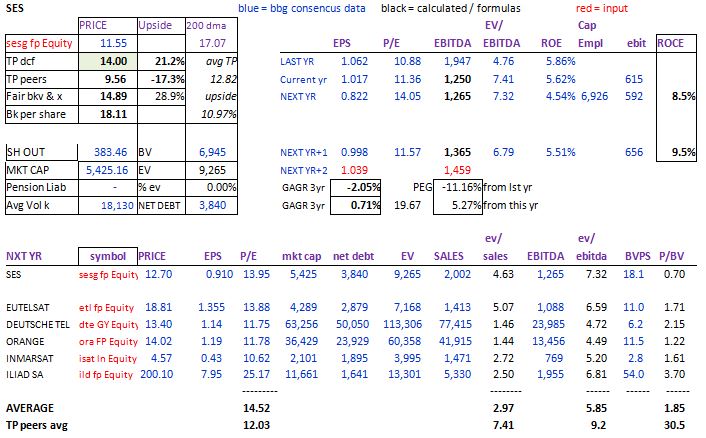

SES GLOBAL

Description

SES SA through its subsidiaries, offers global satellite broadband communications services. The Company offers feeds for cable television networks, Internet access, corporate networks, network facilities, telecommunications services, and audiovisual broadcasting.

Short to medium term BUY thesis:

*Future growth will be derived from the launch of new satellites, especially MEO

* Company announced a dividend cut with their results on Feb 23: hence, covenants of 3.3x net debt to ebitda ratios will not be breached (the share price performance has clearly anticipated the cut)

* OTT substitution and evidence of accelerating declines in video on demand (VOD) but discounted

* Satellites cost is around €250mn per GEO and €75mn per MEO and SES has 53 SEO and 12 MEO: a 20% efficiency improvement would save the company close to €200mn per year or 52c per share.

* Consensus earnings expectations has been under pressure but the 2020 guidance of ebitda margins of 65% should alleviate further downgrades.

Analysis

Two third of SES revenues are coming from VOD (lfl -5% in Q3) which is expected to face a lot of pricing pressure over the next few quarters, especially from:

1. OTT which is cheaper than satellite if a broadcaster has less than 50k subscribers. 90% of broadcasters have less than 5Ok subs. On average only the top 5-to-10 broadcaster in each country have more than 50k viewers

2. Rationalization of uncommitted capex in FY18 could provide further b/s headroom

3. The US video business remains under pressure but beyond 2019 the industry should again see some organic growth.

4. The brightest spot is the growth in emerging markets

O3b, acquired in Q3 2016, offers internet through satellite in countries with low “fixed line” penetration. They use Medium Earth Orbit satellite vs historical Geo-stationary Earth Orbit. O3b currently has 12 satellite and aims to have 20 by 2020. It takes 3 years for a new satellite to reach full capacity, ie, strong growth should come back in 2020/21.

The balance sheet is stretched following the acquisition of O3b which but the dividend cut on February 24th is giving them some breathing room.

Conclusion

The current share price is discounting all the bad news. Africa and emerging markets will continue to rely on satellites for communications and videos. BUY